unemployment tax refund update september 2021

From my knowledge this means that theyve audited my account and I dont owe anything. Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns.

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca

The first thing to know is that refunds would only go to taxpayers who received jobless benefits last year and paid taxes on that money before the provision in the American Rescue Plan Act of 2021.

. Tax refunds on unemployment benefits to start in May. Premium federal filing is 100 free with no upgrades for unemployment taxes. May 18 2021 1129 AM EDT.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. If you received unemployment benefits in 2020 a tax refund may be on its way to you. Each spouse is entitled to exclude up to 10200 of benefits from federal tax.

The American Rescue Plan Act of 2021 offered relief to people who received unemployment compensation in 2020 at the height of the pandemic when companies were laying off millions of workers. As of its last update in late July the agency said it distributed 87 million unemployment-related refunds with the average refund size 1686. The IRS is starting to issue tax refunds on up to 10200 of unemployment benefits received last year.

Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. By Baby Shower September 25 2021 The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

Periodic payments to be made May through summer Español 中文 繁體 한국어 Русский Tiếng Việt Kreyòl ayisyen IRS to recalculate taxes on unemployment benefits. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Wow This Is Crazy Fourth Stimulus Check Update Today 2021 Daily News Daily News Tax Refund Government Shutdown New 600 Stimulus Checks Going Out Major Announcement From The Fed Fo In 2022 Internet Business Stock.

100 free federal filing for everyone. But that doesnt mean the couple as a tax unit always gets tax waived on double the amount 20400. Due to a pause in federal student loan payments through.

Check For The Latest Updates And Resources Throughout The Tax Season. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Thats the same data.

The act excluded up to 10200 in 2020 taxable unemployment income meaning. This is a federal tax break and may not apply to state tax returns. IRS begins correcting tax returns for unemployment compensation income exclusion.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. IR-2021-212 November 1 2021 The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

Unemployment tax refund update. COVID Tax Tip 2021-87 June 17 2021. Anyways I still havent received my unemployment tax refund and there hasnt been.

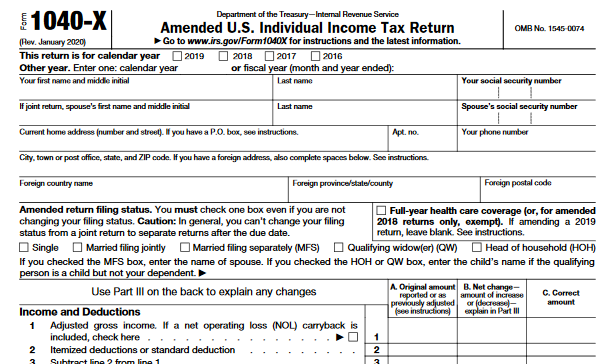

That number can be as much as 20400 for Married Filing Jointly taxpayers if each received benefits. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Hello so I looked at my IRS account transcript and noticed that theres a tax code 290 reading Additional tax assessed with a date of 7-26-2021.

Line 7 is clearly labeled Unemployment compensation. The first refunds are expected to be issued in May and will continue into the summer. People who received unemployment benefits last year and filed tax.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. It excludes up to 10200 of unemployment compensation payments from gross income if the taxpayers modified adjusted gross income is less than 150000. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received in 2020 from federal income tax for households reporting an adjusted gross income less than 150000 on their 2020 tax return.

We have all the latest updates regarding us. Unemployment tax break refund update september 2021. New Exclusion of up to 10200 of Unemployment Compensation.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. A source familiar with the payment rollout told. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes on unemployment compensation received last year.

Unemployment tax refund status. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. You must file Schedule 1 with your Form 1040 or 1040-SR tax return.

Ad File your unemployment tax return free. The newest COVID-19 relief bill the American Rescue Plan Act of 2021 waives federal taxes on up to 10200 of unemployment benefits an individual received in 2020. This is the latest round of refunds related to the added tax exemption for the first 10200 of.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. The tax break is for those who earned less than 150000 inadjusted gross incomeand for unemployment insurance received during 2020At this stage.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March.

Still Waiting On Your Tax Refund Here S What To Do Sep Experian Experian

State Income Tax Returns And Unemployment Compensation

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Millions Still Due 2020 Tax Refunds As October 15 Extension Deadline Nears

Still Waiting For A 2020 Tax Refund Try This Fox43 Com

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Composing A Financial Contingency Plan Taxes Humor Emergency Fund Financial

Tax Season 2021 Is Open And Comes With A Lot Of Issues The Washington Post

Lumber Executive Says Drop In Prices Has Reignited Demand For Building Projects Building A House House Prices Home Construction

State Income Tax Returns And Unemployment Compensation

Where S My Refund For All The People Impatiently Waiting

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Where S My Refund For All The People Impatiently Waiting

Estimated Income Tax Payments For 2023 And 2024 Pay Online

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Irs Says Taxpayers Should Not File Amended Tax Returns Due To Stimulus Law

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)