ventura property tax rate

The Ventura County property tax rate is 125 of the assessed property value. Ventura County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly youre unfamiliar that a property tax bill.

County Of Ventura Webtax Search For Property

County of Ventura - WebTax - Search for Property.

. County Line Sales Taxes Property Taxes Below is a general idea of what to expect to pay in property taxes in each city. The minimum tax is 750 for each tax bill. As of July 1 2022 any unpaid Secured Tax Bills from 2021-2022 fiscal year are now defaulted and CANNOT BE PAID.

Revenue Taxation Codes. Mails out the property tax bills. Receives the assessments from the Assessor and applies the appropriate tax rate to determine the actual amount of property taxes owed.

City or School District Areas Areas Tax Rate Range. Search for Tax Rate Information. Total tax rate Property tax.

Of Tax Rate. Revenue Taxation Codes. Tax Rates and Other Information - 2021-2022 - Ventura County.

Please contact the Auditor. Property tax process on a county-by-county basis. The average yearly property tax paid by Ventura County residents amounts to about 361 of their yearly income.

Ventura Property Taxes Range Ventura Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps youre unaware. Camarillo City 373 07 1090900 1154338. Information contained in this database is derived from the current fiscal year Tax Rates General Information publication.

1 is the max that the. Our Ventura County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Ventura City 186 05 1034700 1169900.

Ventura County is ranked 342nd of the 3143 counties for property taxes as a. The median property tax also known as real estate tax in Ventura County is 337200 per year based on a median home value of 56870000 and a median effective property tax rate of.

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Ventura And Los Angeles County Property And Sales Tax Rates

Simi Valley Industrial Property 220 W Los Angeles Ave Simi Valley Ca 93065 Usa Real Estate Listing Quantumlisting

County Of Ventura Webtax Search For Property

Los Angeles County Ca Property Tax Search And Records Propertyshark

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

Property Tax Information Moorpark Ca Official Website

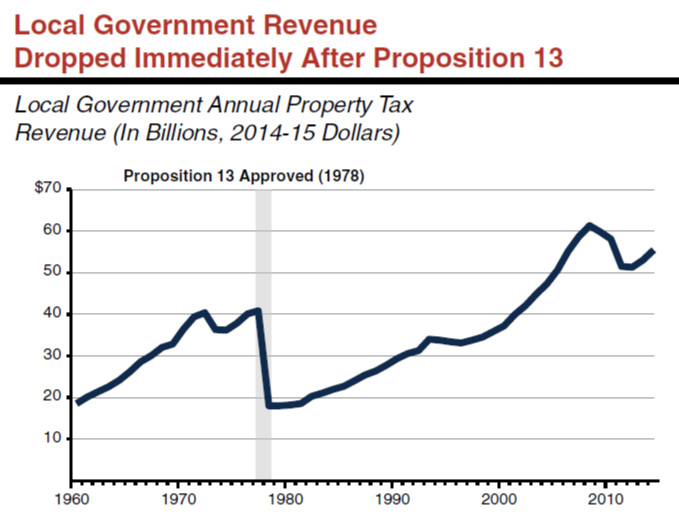

Real Estate Taxes Calculation Methodology And Trends Shenehon

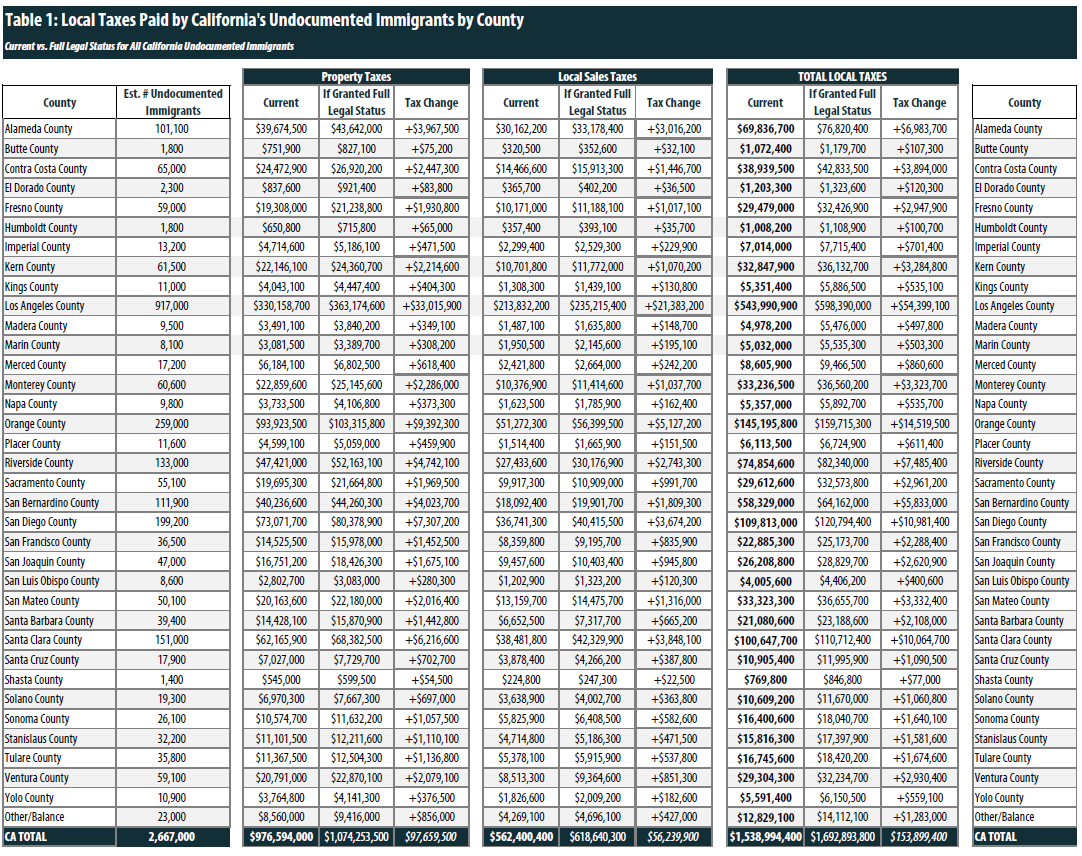

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

Ventura County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Sales Tax Information Moorpark Ca Official Website

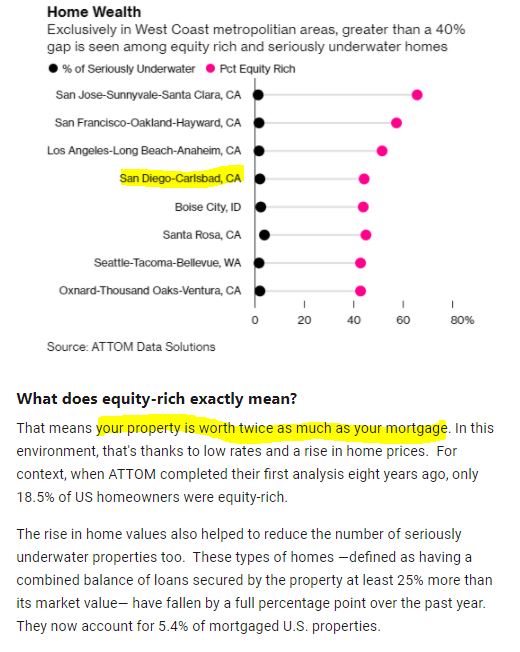

Property Tax Re Assessment Bubbleinfo Com

Yuba County Ca Property Tax Search And Records Propertyshark

Ventura And Los Angeles County Property And Sales Tax Rates

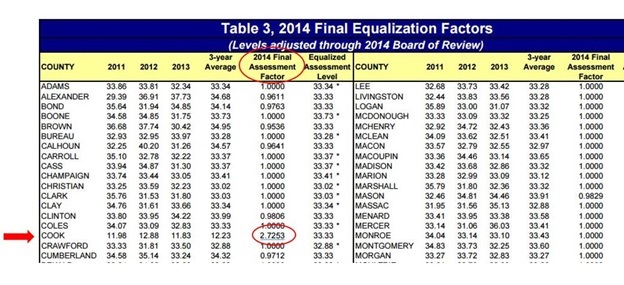

Calculate Your Community S Effective Property Tax Rate The Civic Federation

2022 Best Places To Buy A House In Ventura County Ca Niche

31 Cent Property Tax Increase Approved For Maury County Homeowners